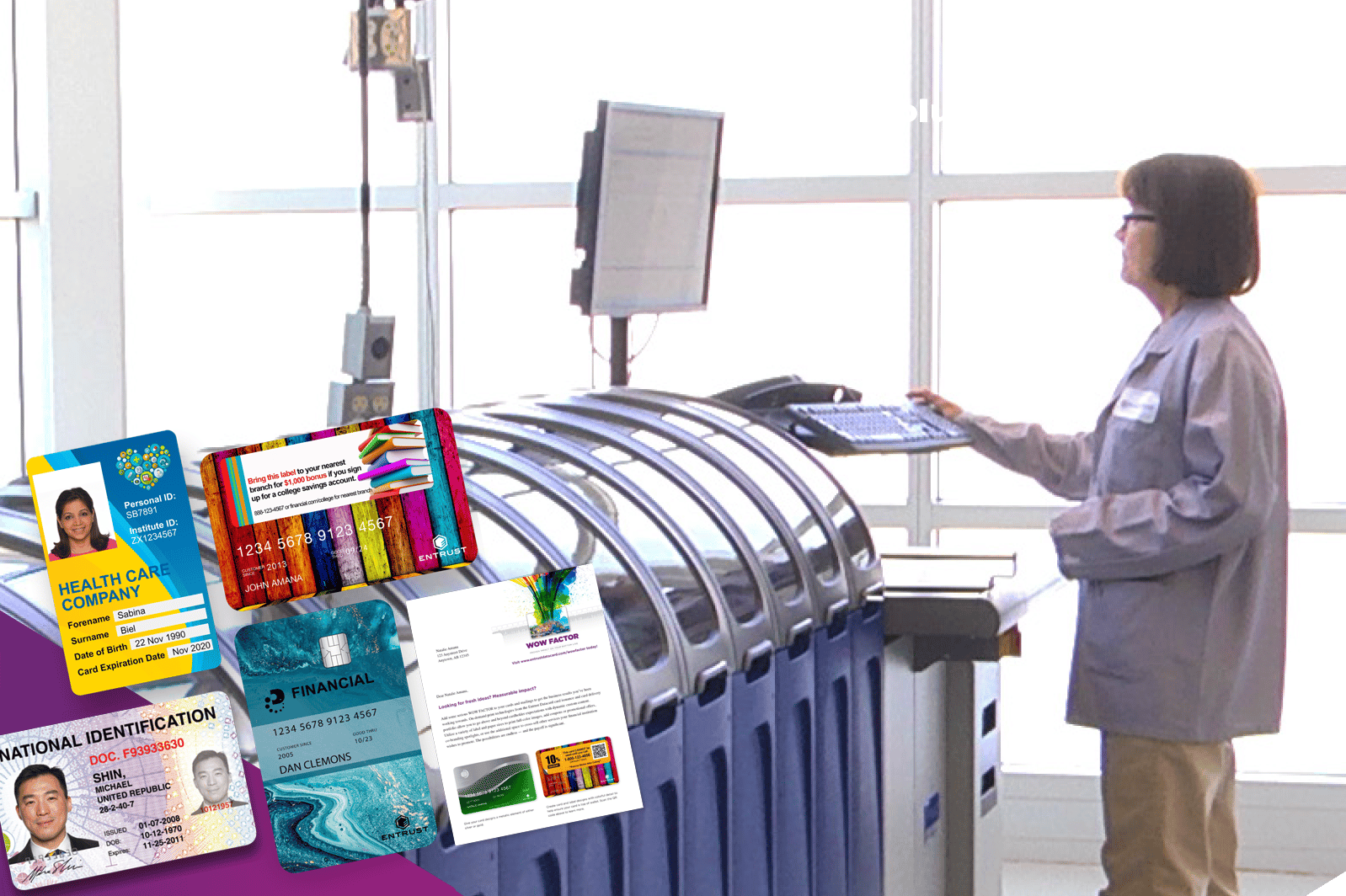

Financial institutions value the quality and security Elliott’s financial issuance solutions provide not only for financial card issuance but for facility security as well. Elliott’s financial IFI Solutions make instant issuance practical and affordable. They help banks and credit unions deliver an outstanding customer experience with speed, convenience, and security. With secure financial instant issuance printers, bank branch personnel are able to hand a new debit/credit card to account holders in minutes and they can begin using it immediately; giving customers what they want, when they want it. Elliott Financial Card Issuance Systems meet industry standards for the FII market. Our secure issuance printers ensure the highest level of security and reliability for your financial institution. Elliott’s high-end security solutions for staff identification, access control, video surveillance, digital credentials and much more make them the perfect local source for banks and credit unions technology solutions.

Financial Solutions

Financial Card Instant Issuance Printers

Deliver an outstanding customer experience with speed, convenience and security using Elliott’s Instant Financial Issuance Debit/Credit Printers.

Financial Card Issuance & Digital Banking Cards

Securely process financial cards meetings all of todays standards and regulations while putting cards into customer hands instantly.

Digital Credentials

Use your smartphone to validate identity digitally and perform local access to buildings, secure locations, VPNs, laptop and more.

Access Control Software

Secure interior and exterior doors using a variety of integrated access control software and locks. Assign full or limited access to access control doors by assigning rights to employee, student or visitor ID cards and adjust permissions at any time without reprinting ID cards.

Access Control Readers

Access control keypads, RFID proximity card readers, contact and contactless card readers for interior and exterior door security.

Video Surveillance Software

Access visual status of secure locations from any location using cloud video surveillance software anywhere, anytime.

Video Surveillance Cameras

Choose from high quality interior and exterior video surveillance cameras to provide a higher level of facility security.

Data Capture Products

Capture basic driver’s license data with a quick scan of their ID or capture signature for document verification.

ID Card Accessories

Create customized lanyards, purchase ID card holders, badge reels, or ID printer supplies such as ribbon, laminate, and cleaning supplies.

ID Card Supplies

Create customized lanyards, purchase ID card holders, badge reels, or ID printer supplies such as ribbon, laminate, and cleaning supplies.

High Volume ID Card Printers

Print large numbers of cards from one centralized location and issue out to multiple locations. Print high quality cards fast and in great numbers.

Concealed Weapons Detection

Take weapons detection to a whole new level by using advanced AI sensor technology and AI to detect concealed weapons quickly, while keeping lines of people moving with limited interruptions.